NEW DELHI/MUMBAI:

Automakers are divided over the impact of goods and services tax, but expect a spike in demand for compact cars and SUVs over the next few weeks from buyers

trying to beat a possible price hike. Large vehicles may, however, see

some deferrals in purchase because the new indirect tax regime is

expected to reduce prices in those segments.

At first glance, the rates fixed under GST

last week looks slightly higher for small passenger vehicles compared

with the current bunch of indirect taxes levied on them. On large

vehicles, the new rate is lower. Several industry executives and experts

expect vehicle prices to reflect the change in rates. Higher input

costs will also likely influence price revisions in July, said the India

head of a European carmaker.

Rakesh Srivastava, director

of sales and marketing at Hyundai Motor India, expects prices in the

compact segment to go up 1-3%, affecting almost 85% of the overall

passenger vehicle space. And, he has already started witnessing an

increase in customer visits at dealerships. "The enquiries and footfalls

have shot up. The sub-4 metre (or compact) segment buyer is extremely

price sensitive; especially at the entry-end consumers will seek to get

vehicles at the best price point," Srivastava said.

RC

Bhargava, chairman of market leader Maruti Suzuki, however, is among

those who don’t expect major changes in prices. "At present, excise duty

is levied on ex-factory price of a vehicle.

A number of charges are added on, including octroi, transport costs,

dealer margins and state levies. The actual incidence is about 29%,

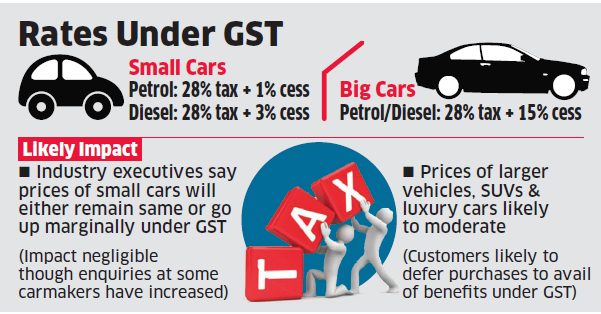

which is same as the rate in GST," he said. The GST Council that decided

on the new tax rates put cars and SUVs in the highest slab of 28%, and

imposed an additional cess of 1% and 3% on small petrol and diesel cars,

respectively, and 15% on large cars and luxury vehicles. The current

levies range from 25% on small cars to 55% on luxury vehicles. The cess is to recover revenue loss due to implementation of GST.

Sugato Sen, deputy director general of the Society of Indian

Automobile Manufacturers, said the calculations were complicated and

that the impact on prices would vary. "Depending on the state of sale,

prices in the small car segment may either remain the same or go up

marginally," he told ET.

Gaurav Vangaal, senior analyst at

IHS Markit, predicts an increase in demand for small cars before July 1.

"India is a price sensitive market. If there are indications of

vehicles becoming dearer, you witness a pull in the market," he said.

Honda Cars India expects prices of small cars to go up. "Our team is

working out the details of pricing under GST. But it looks like that

small car prices may go up," Jnaneswar Sen said.

While the

actual impact of GST on small cars may not be clear yet, most expect the

new rates to help lower the prices of vehicles at the more premium end

of the market. "Currently, total levies on luxury cars amount to around

55%. If the 28% tax rate and an additional cess of 15% is levied, then

vehicle prices will come down," said an executive at a leading luxury

car maker, who did not wish to be named.

Hyundai’s

Srivastava concurred. He expects a moderation in price in bigger

vehicles. This expected price reduction may lead some customers to

postpone purchases, he added. Roland Folger, managing director at luxury

vehicle maker Mercedes-Benz India, said his company is waiting for the

official notification on the GST rates and was "currently studying the

effects that might emerge out of the GST implementation".

VG Ramakrishnan, managing partner at consultancy firm Avanteum Advisors,

said any vehicle more than four metres in length and fitted with

engines larger than 1500 cc will see a reduction in price.

Those looking to buy large SUVs or MUVs are likely to delay purchases to avail of benefits under GST, he said.

24 May 2017, 07:13 AM