The new Goods and Services Tax (GST) regime will bring several benefits

for the economy, and could particularly vitalise the fast-moving

consumer goods (FMCG) industry.

Apart from driving supply

chain efficiencies, bringing untaxed players into the tax net—a large

section of the industry still operates in the unorganised segment— will

level the playing field for the larger, established players in the

industry.

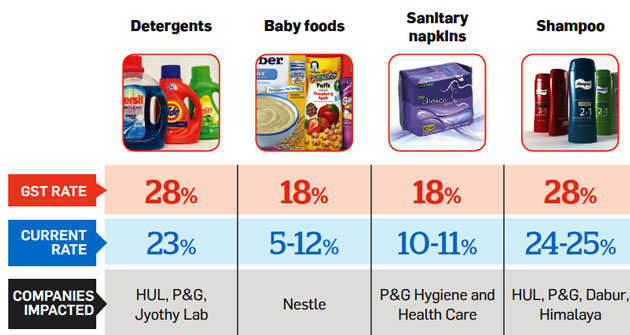

However, the GST rate structure shows that not all FMCG companies stand to benefit from the new regime.

Products to be taxed at higher rate

GST beneficiaries

The rates for various FMCG segments have mostly been along expected

lines. Items of mass consumption—toothpaste, soaps, hair oil—have been

put under the 18% tax slab, significantly lower than the 22-24% tax rate

they have been paying. This is in accordance with the government’s

stance of keeping tax rates low for mass consumption products. In fact,

the GST rate schedule indicates that nearly 81% of all items are in the

18% tax bracket or below. The remaining 19% fall in the 28% tax slab.

Products to be taxed at lower rate

The FMCG companies, whose tax incidence

has come down under the GST regime, are likely to pass it on to the

consumers in the form of lower prices. "With the anti-profiteering

clause in place, companies would be required to pass on the benefit of

tax rates to the consumer in the form of lower prices," says Sanjay

Manyal, Analyst, ICICI Securities.

Lower prices could

potentially support volume growth for certain products, particularly in

the rural segment. "We believe it could result in a faster consumption

shift from unbranded to branded products, spurring volume growth for

FMCG companies. Simultaneously, it will also bring operational

efficiency with rationalisation of supply chain by removing

bottlenecks," says Manyal. Analysts also point out that tax exemption

provided to several critical products required for food

processing—jaggery, cereals and milk— would benefit this industry.

So, which are the companies that stand to gain from a benign tax

regime? The extent of impact would depend on the product mix of the

companies. Oral care major Colgate Palmolive is likely to emerge as the

biggest beneficiary. "Colgate pays an effective tax of 25-26%. The new

18% tax on toothpastes (make up 80% of the company’s sales) is a

positive, particularly as it levels the playing field against Dabur and

Patanjali, who enjoy tax benefits," says a Motilal Oswal report. Hair

and edible oil companies too will benefit. "Marginally lower rates in

hair oil with no increase in edible oil rates will benefit Marico," says

an Axis Capital report.

Adversely impacted firms

Surprisingly, some of the widely consumed products have been placed

under the highest tax slab of 28%—slightly higher than the rate levied

earlier. "Higher tax rate in paints and possibly baby food will

marginally impact Asian Paints and Nestle," says the Axis Capital

report. Higher tax rate for detergents and shampoo is a real dampener

since these are daily-use, mass consumption items. Manufacturers will

have to pass on the higher tax incidence to consumers in the form of

higher prices of these goods.

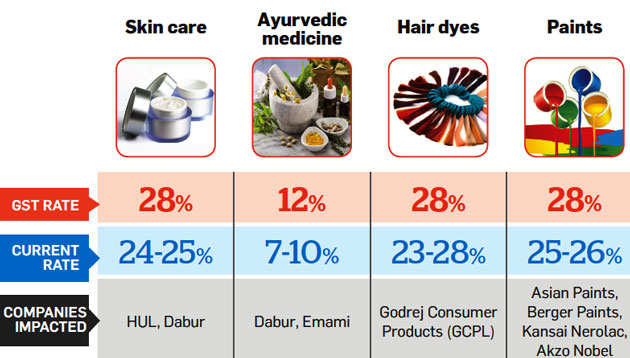

However, it will not have

much impact on the sale volumes, say analysts. Most of the items

belonging to the premium category have been put under the highest tax

slab of 28%. These include health supplements, skin care, aerated

drinks, liquid soap, among other goods. But this is not going to have a

particularly negative impact on manufacturers as they had been paying

similar taxes earlier. The increase, in some cases, is only marginal.

However, the firms who were focusing on premiumisation of their product mix to drive profitability,

could be hurt because of the higher taxes. These firms may have to

rethink strategy and realign their portfolio. Ayurvedic products—a

segment that is seeing increased focus from leading FMCG players—are to

be taxed at 12%, slightly higher than the prevailing rate. This may hurt

Dabur, which has a wide portfolio of ayurvedic products. Emami too

could come under pressure. Ayurvedic players were expecting the tax rate

to go down, given the government’s thrust on popularising traditional

Indian medicine.

For most other FMCG majors, the GST rate

structure is likely to be neutral or marginally positive, as their broad

portfolios would see a mixed impact. In case of HUL, for instance, tax

incidence has reduced for soap, toothpaste and tea, but increased for

detergent, shampoo and skin care. For Godrej Consumer Products, lower

tax incidence on soaps and insecticides is a positive, but higher tax

rate for hair dye is a negative.

29 May 2017, 08:41 AM